PCM Newsletter

Our quarterly newsletter provides market commentary, portfolio updates, and insights into our investment thinking. Browse the archives below.

Q4 2025

+Dear Friends of Peattie Capital,

A few thoughts as we close 2025….

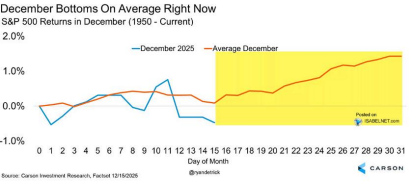

Whether the goal was aggressive growth or preservation of capital, (or anything in between) 2025 has been another terrific year at Peattie Capital. If past is prologue, there might be a little more upside in the last couple weeks.

Reminder that Peattie Capital manages separate accounts and builds portfolios based on specific client needs, goals and constraints and that past performance is not a guarantee of future returns

It’s a fantastic time to be a growth investor: AI……and Space

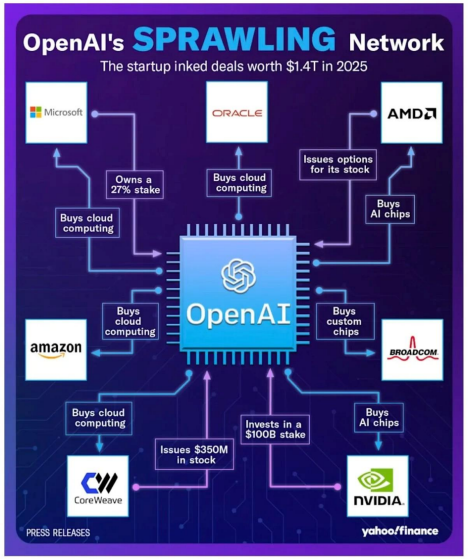

I think AI is real and I think AI infrastructure provides the best opportunity today to generate gains. Both AI and Space share characteristics with previous emerging industries such as railroads, autos, and the internet. Each of these began with a rising wave that lifted most participants in the earliest days, followed by a washout after which the strongest companies began to emerge.

The dotcom bust (AKA Internet 1.0) comes to mind, with the differences that many of today’s companies are profitable or on a demonstrated path to profitability and also several of today’s participants are the largest companies in the world with billions of dollars on their balance sheets.

Most accounts own a few names in AI security and infrastructure on the belief that they will scale with the industry and are needed by everyone, rather than trying to evaluate whether ChatGPT or Gemini (or whoever) will attract the most users.

One potential risk for the AI industry is circularity/vendor financing as many participants are both suppliers to and buyers of one another’s products. Above is a diagram of Open AI’s connections with others in the industry.

And space too

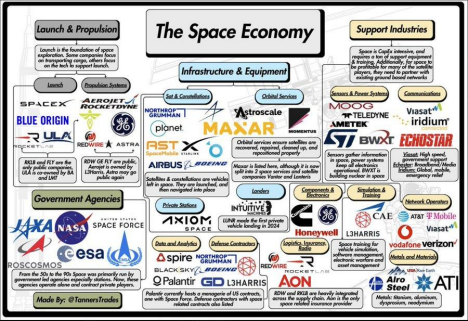

As for space, I also think it will be an important industry over the next decade and below is a nice summary of the industry which came across my desk. My favorite companies so far are Rocket Lab (“RKLB”) which is a dominant force in smaller spacecraft launches and I also like AST SpaceMobile, (“ASTS”) which provides communications.

In addition, Alphabet (“GOOG”) owns about 8% of Elon Musk’s SpaceX, which is considering an IPO in 2026. Originally a $900 million investment in 2015, GOOG’s position is now estimated to be worth roughly $110 billion. GOOG is going to remain a critical company in the future and is a core holding in many Peattie Capital portfolios.

Another way to own SpaceX is through the Ark Venture Fund (“ARKVX”), a closed-end interval fund which owns both public and private companies.

One last thought, which is that most portfolios with an abundance of growth names also have a few bigger, more established blue-chip names as well. In 2025 those included Abbot Labs and JP Morgan for example and recently I’ve added Bristol-Myers also.

Merry Christmas! We begin 2026 with a fresh batch of liquidity!

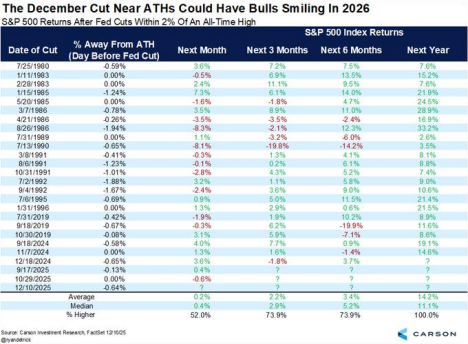

Generally speaking, I welcome more liquidity, and at its December 10 meeting, the Federal Reserve announced (in addition to its 25-basis point rate cut) that it would begin monthly purchases of Treasury securities. While it is not called “Quantitative Easing”, many believe it is effectively the same thing. The Fed says the purpose is to maintain adequate bank reserves.

Regardless, I can’t help but wonder what all this liquidity might mean longer term as inflation is still running above the Fed’s stated goal of 2%.

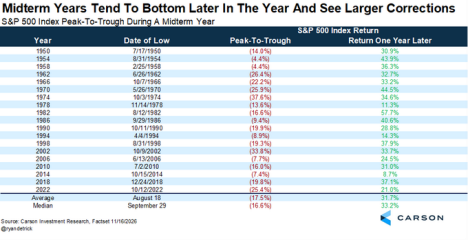

While 2026 will start with abundant liquidity, mid-term years tend to be more volatile overall.

January can be a tricky month with a variety of cross currents as sellers have waited for the new year before taking profits and rebalancing across asset classes can influence short term movements. Overall, I remain optimistic but am keeping an eye on valuations as markets are generally expensive.

That said, I believe in a “market of stocks” rather than a “stock market” and maintain that there are terrific growth opportunities right now. Reminder here that very rarely do stock prices move in a straight line and growth companies in particular are prone to headlines and narratives, which can cut both ways. After dropping from nearly $70 to $40 from late October through Dec. 2nd, the aforementioned RKLB announced its biggest contract ever Thursday, and the stock jumped right back to $70, and then $74 in the aftermarket Friday after the close. Those kinds of moves are the price of admission in emerging industries.

RKLB has gained 177% year-to-date, even better than a couple other core holdings this year TransMedics (“TMDX”) and Applovin (“APP”) which have gained 105% and 122% respectively.

I am grateful for all the continuing support and wish everyone a safe and happy holiday season. Feel free to contact me with any questions or comments.

Best regards,

Bill

Q1 2025

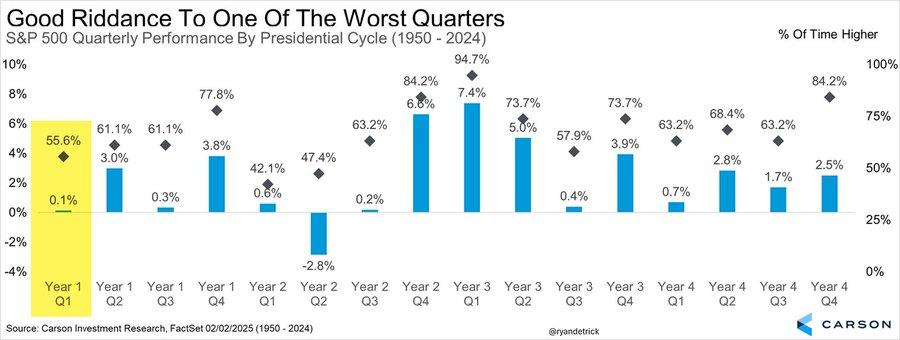

+2025 is off to a very rough start

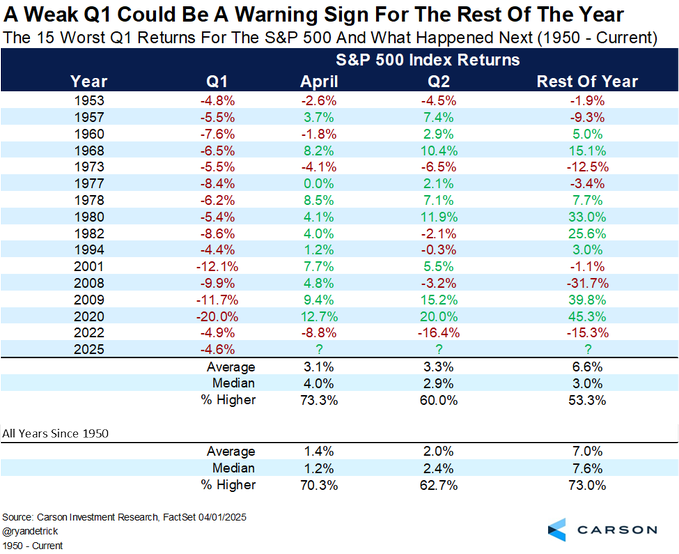

The first quarter has been extremely rough as Trump’s policies have created significant uncertainty for the markets…and uncertainty is enemy #1 for stock prices.

Earnings season was basically good, however guidance and comments about the unknown impact of tariffs and government cutbacks triggered selloffs across the board. Some companies delivered stellar results and raised guidance leading to a short-term bump in the stock price, but within a day or two even they met with heavy selling.

There’s no telling when the selling will stop as fundamentals and valuation take a back seat to the macro headlines, and selling begets more selling. Hedge funds control massive investment funds and frequently act in unison in the markets, and in 2025 they have been selling long positions (“de-grossing”), especially in tech.

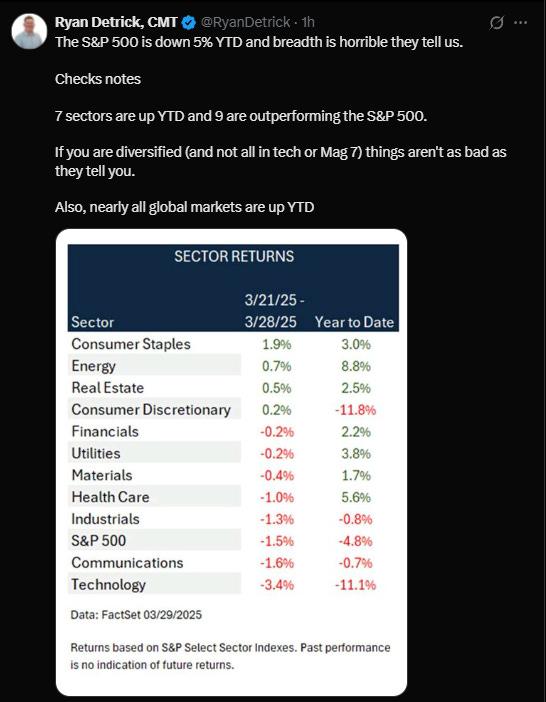

Then machines take over and extend the momentum whichever way it was going. For the past few years, technology was king and buying strength was a winning formula. So far this year it’s more about picking spots, only buying small positions, and in some cases, moving quickly out of losing positions. The more defensive areas have held up well, but technology and growth companies in particular have been hit very hard.

In taxable accounts I have stayed in most positions as I believe in them and selling names with significant unrealized gains and outstanding mid/long-term prospects presents the double whammy of paying taxes and then timing the re-purchase of shares correctly.

International and Value-Oriented Companies

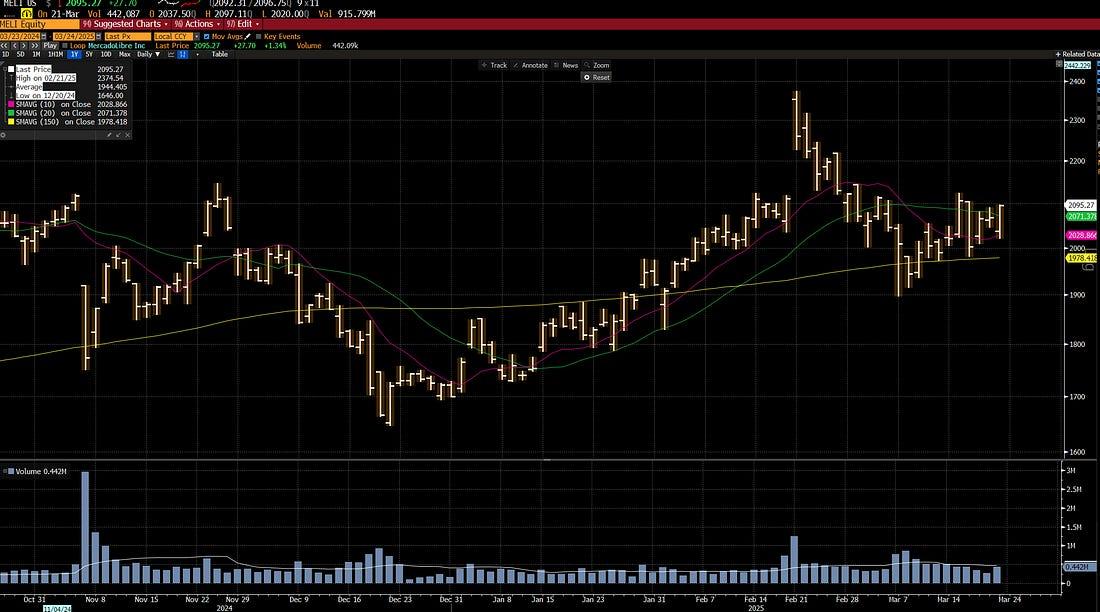

International markets have been outperforming U.S. markets this year and most Peattie Capital accounts own Mercado Libre (“MELI”), which is often referred to as the Latin American Amazon. Another company I like very much because of its monopolistic position in semiconductor equipment is Dutch company ASML Holding N.V. (“ASML”). Alibaba (“BABA”) and TenCent (“TCEHY”) are leading Chinese tech companies and for more aggressive accounts I have been adding them.

In conservative accounts I have been adding Treasury Bills and not buying any equities whatsoever.

Reasons for optimism

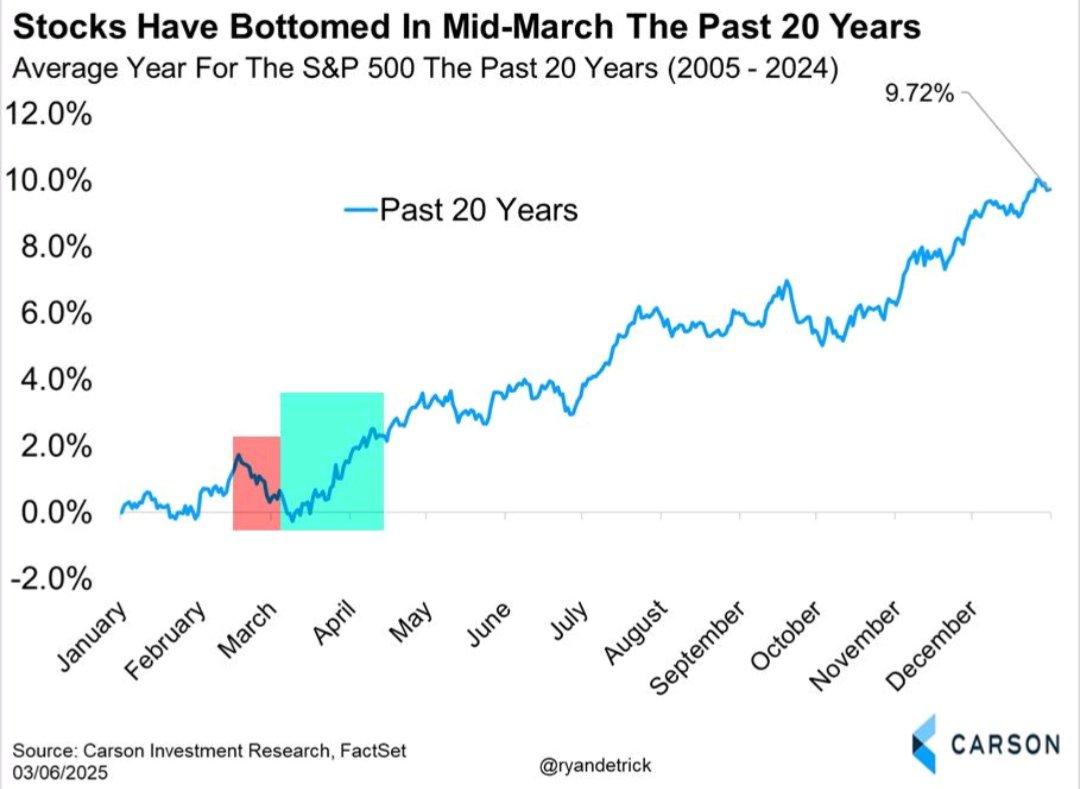

Over the past 20 years, stocks have been weak early in the year and then performed well the rest of the year. In the current environment, however, everything is overshadowed by the chaos in Washington.

Tom Lee has been bullish and correct for several years, and he remains constructive on the markets:

In 2018, Trump made remarks about tariffs at Davos on Jan. 26, triggering a plunge until Feb. 19, when the VIX surged and equities bottomed, with the S&P 500 retreating to support above the 200-day moving average. Investor sentiment measures showed bearishness continuing well after that bottom. “If we fast-forward to 2025, a similar pattern appears to be unfolding,” Lee noted, so “if the 2018 comparison holds, equities could be poised for sustained upside.”

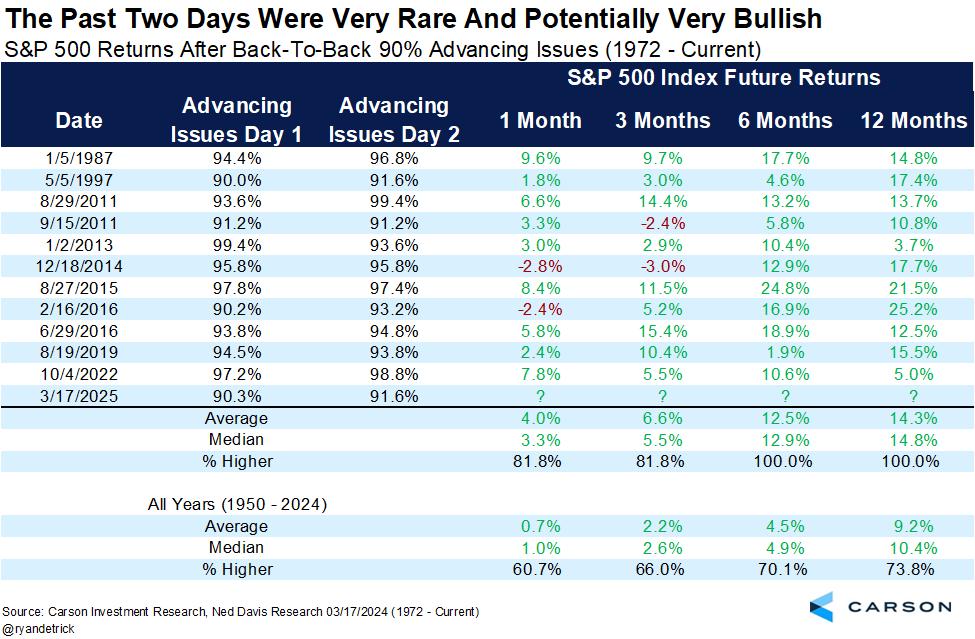

Additionally, two straight days with 90% advancing issues is highly unusual and has been a good indicator for the past 40 years.

Indisputably, attractive values are being created for some growth stocks, as measured by market cap/EBITDA as a % of the EBITDA growth rate, a common valuation tool for them.

For example, Fan Duel parent Flutter (“FLUT”) and Draft Kings (“DKNG”) are now trading at/below half their growth rate. FLUT has a market cap of about $39bn, and EBITDA is expected to be about $2.5bn in 2025, then grow about 30% for the next couple years. So, the market cap/EBITDA is roughly 15x, which is about half the growth rate.

At $34, DKNG has a $16bn market cap with expected EBITDA in 2025 of $950mn, a ratio just over 17x. DKNG’s EBITDA growth is expected to be north of 50% for the next couple years so by this metric shares are even cheaper than FLUT’s.

To be sure, a recession would change things and future growth rates are uncertain. But for growth-oriented accounts, these are the kinds of valuations that have historically worked out well. That said, it’s impossible to say whether they get cheaper before they rally.

A few other names I like:

Below is a chart of the aforementioned MELI, which is down about 13% from its February high but still up about 15% for the year.

Source: Bloomberg

Another company I like very much right now is Take Two Interactive (“TTWO”) which will be releasing the next version of Grand Theft Auto later this year. Here’s what’s happened around prior releases…and the last one was 12 years ago.

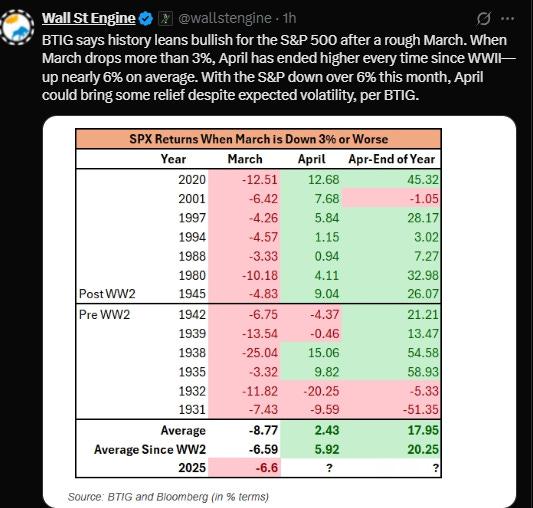

Here are a few other tweets that I like which have some data on both sides:

|

My conclusion is that opportunities abound but until there is more clarity on tariffs volatility will linger. I am cautious about any new positions, particularly in technology, which has been a terrific place to invest the past few years.

For now, patience and a strong stomach are required.

Please feel free to contact me with questions or comments.

Questions About Our Commentary?

We're always happy to discuss our market views and investment approach.

Contact Us